NCBIO forum explores moving technology through funding phases

A high quality board of directors and valuable outside partnerships are two advantages that biotech startups would do well to cultivate, according to the expert panelists assembled for the NCBIO Emerging Company and Technology Forum held Wednesday, March 16, at the NC Biotechnology Center.

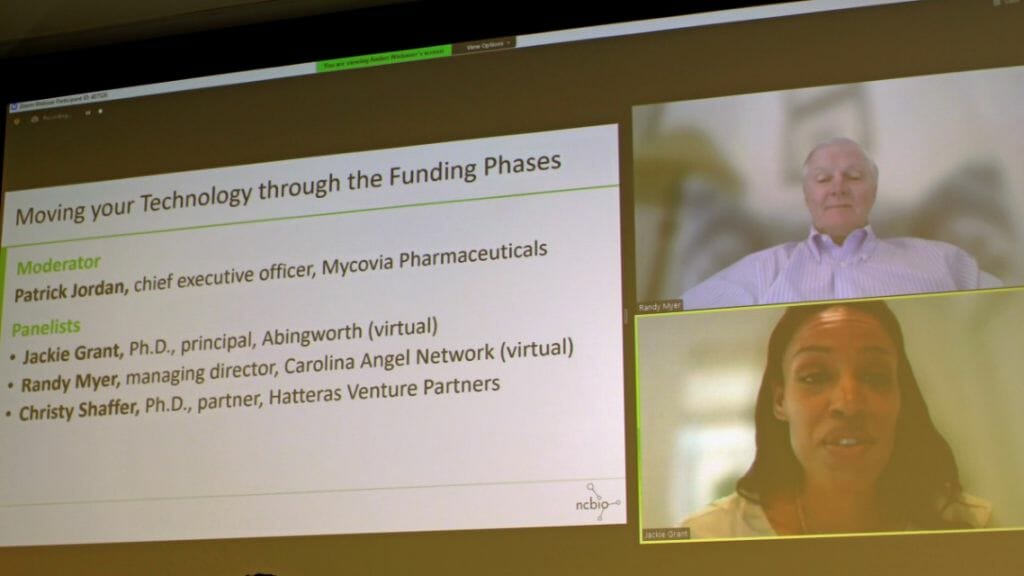

The panelists were moderator Patrick Jordan, CEO of Mycovia Pharmaceuticals; Jackie Grant, Ph.D., principal at Abingworth; Randy Myer, managing director of the Carolina Angel Network; and Christy Shaffer, Ph.D., partner at Hatteras Venture Partners.

The event was sponsored by Marsh & McLennan, Nikon Instruments and Wyrick Robbins.

Panelists said that, when crafting appeals to investors, life sciences startups often focus on their published science and the funding they have received from the National Institutes of Health and similar organizations. While those elements are important, investors are also looking to see if the company has made the internal and external connections that can help it succeed, as well as a checking to see if the CEO is willing to listen and learn.

"To us, one of the most important things is looking at your board," Myer said. "I don't mean your scientific board, I mean your board [of directors] because we want to know that we have people that can help you through the decisions and pivots that you'll have to make. We look very heavily at that.

"The other one that I mentioned very quickly is how do we think about you as a person?" he said. "And what are the characteristics that we look for? Well, probably the most important is what we call coachability."

Shaffer agreed, saying, "We're looking for companies that have great science, and that's evidenced by having some sort of validation, either by NIH grants; SBIR STTR grants; publications in Science, Nature, PNAS, anything that validates the science. And a scientific founder that is also coachable. That is something that is very important to us [along with] being able to create a team."

About Abingworth, Grant said, "We are very committed to building value over time. Over the lifetime of an investment, we will typically invest anywhere from $20 million to $35 million, and I think it's fully appreciating that drug discovery and development requires a lot of capital, it requires a lot of time.

"I'm a scientist by training, and I'm looking at very early stage companies where they're solving a clear unmet need and where I can readily understand the value proposition. That's usually with programs that either have the potential to be first in class or best in class."

Jordan summed up by saying, " A common denominator goes through it all: a strong team and a strong leader that is shepherding these products through and is going to take advantage of the insights that investors can bring. I think for all of us, it's not just money, but we want to be able to drive value into your assets."